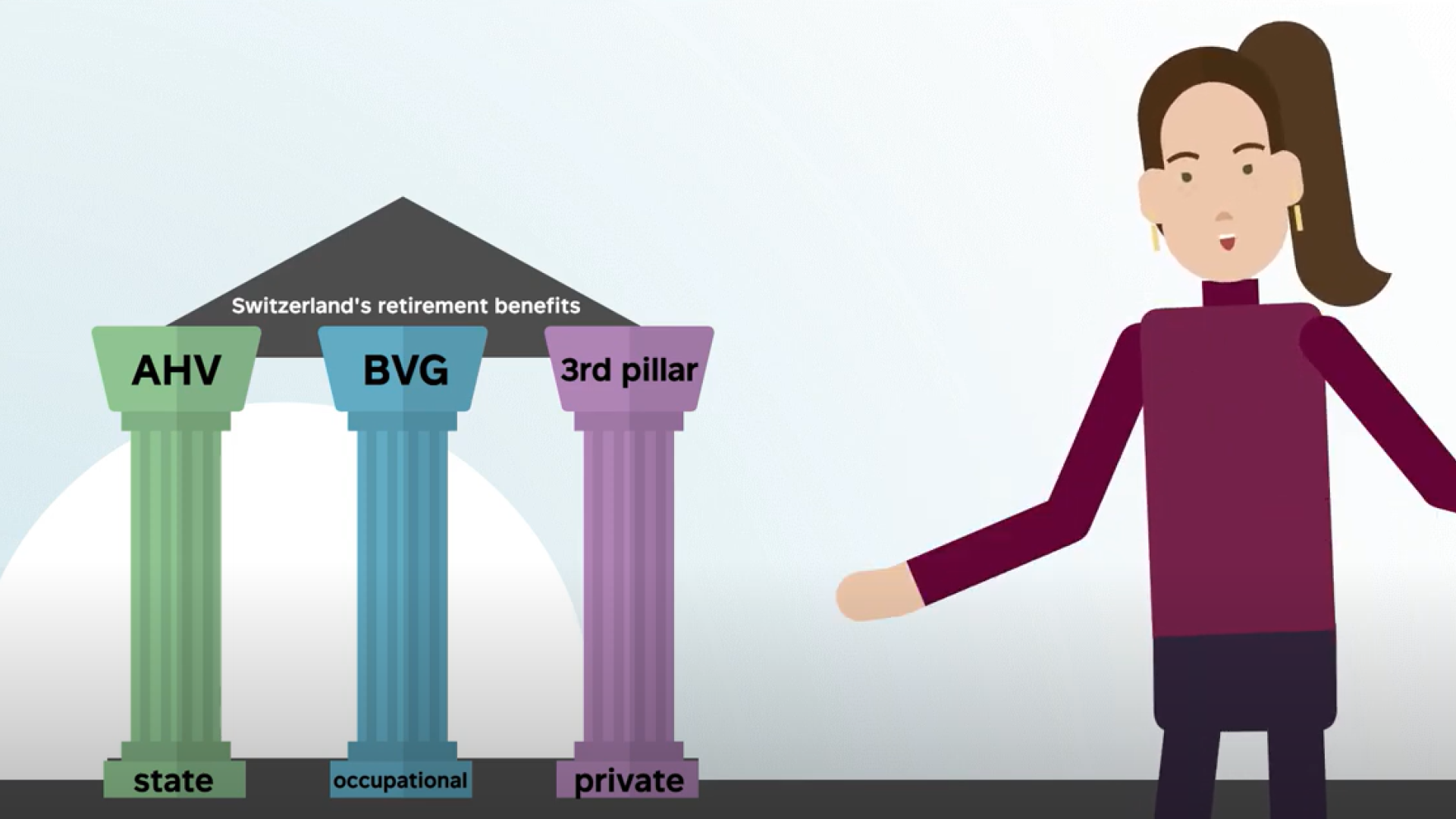

Welcome to Switzerland! You may be wondering how our pension system works. Here you will find all the important information you need to quickly find your way around and take responsibility for your own pension.

Compulsory occupational retirement benefits

If you are employed in Switzerland and your salary is above the statutory entry threshold (in German), you will automatically pay into the 1st pillar (AHV/IV) and the 2nd pillar (pension fund). These two pillars constitute compulsory provision.

The 3rd pillar is voluntary and can be taken out individually at a bank or insurance company. It offers you the opportunity to make additional, tax-advantaged provisions for your future.

Optimise retirement benefits

What you should know

Depending on the residence permit and income, different tax regulations apply to you in Switzerland. Without a residence permit (without certificate C), you are generally subject to the so-called withholding tax. An exception applies to spouses of Swiss citizens or foreign nationals with a residence permit (certificate C). The withholding tax is deducted directly and automatically from the gross salary.

For example, the following are subject to withholding tax:

- Income from employed work and all wage allowances

- Ancillary income

- Replacement income such as daily sickness allowance or pensions (e.g. AHV)

Tax liability is regulated at the cantonal level. Detailed information: Canton of Zurich (in German), Canton of Geneva (in French), Canton of Basel (in German) and Canton of Zug.

In particular, in the case of an annual gross income of more than CHF 120,000, a subsequent ordinary tax assessment must be applied for in addition to the automatically deducted withholding tax. In this case, a tax return must be submitted.

Subsequent ordinary assessment upon request

You can also apply for the subsequent ordinary assessment voluntarily in order to benefit from additional deductions that are not included in the withholding tax rate or are only included in the flat rate. This is particularly worthwhile if, for example, you pay high contributions into pillar 3a, make purchases into the pension fund (BVG), have above-average occupational costs or training costs, wish to deduct childcare costs or claim debt interest or sickness costs. The application for subsequent ordinary assessment must be submitted by 31 March of the following year at the latest.

More information:

- SR 642.118.2 - Verordnung des EFD vom 11. April 2018 über die Quellensteuer bei der direkten Bundessteuer (Quellensteuerverordnung, QStV) | Fedlex (in German)

- Nachträgliche ordentliche Veranlagung beantragen | Kanton Zürich (in German)

Whether tax optimisation is possible therefore depends on your residence permit and your income. We recommend that you seek advice from a specialist tax professional.

Please also note:

Depending on the legislation of your home country, you may also have to file a tax return there. However, this does not automatically mean double taxation. Switzerland has concluded agreements with around 100 countries to avoid double taxation.

You can find more information here (in German).

Purchase into the pension fund

Purchases into the pension fund are a proven tool for tax optimisation:

- They may be fully deducted from taxable income.

- The assets remain tax-free until withdrawal.

- Staggered purchases over several years help reduce tax progression.

- In the case of a later withdrawal of a lump sum, a reduced lump sum tax is usually incurred.

However, the following rules must be observed for expats:

- Special regulations after moving: In the first five years after the move from abroad, a maximum of 20 per cent of the insured salary may be purchased per year.

(Source: SR 831.441.1 - Verordnung vom 18. April 1984 über die berufliche Alters-, Hinterlassenen- und Invalidenvorsorge (BVV 2) | Fedlex) - Three-year vesting period: After a purchase, the capital cannot be withdrawn for three years – neither for early withdrawals (e.g. home ownership), nor for cash payments, nor for early retirements.

- Pension purchases are generally possible until shortly before retirement. However, anyone who plans to take a lump-sum payment must observe the three-year vesting period in order to avoid tax disadvantages.

(Source: Einkauf in die Pensionskasse | Raiffeisen) - Observe death rule: Not all pension funds pay out voluntary purchases to survivors. If you are insured with Profond and die before retirement, your relatives will receive back all of your saved and purchased retirement assets. If you are insured with another pension fund, check the applicable regulations carefully before purchasing.

We recommend that you seek advice from a specialist tax professional.

Pillar 3a: Private pension

By paying into pillar 3a, you save for the future and benefit from tax advantages:

- Contributions are deductible from income.

- The capital is exempt from wealth tax until it is drawn.

A payout is only possible under certain conditions, such as buying a home.

Retirement benefits as protection for your loved ones

With the pension fund, you not only provide for your old age, but also protect your family and your partner. Depending on the pension fund, you are entitled to different benefits. Check with your HR department or directly with your pension fund for details.

At Profond, the following applies:

If an insured person dies, the surviving dependants receive the saved retirement assets as a lump sum payable at death – under certain conditions even after retirement (pension with capital protection). With the beneficiary order, you can determine for yourself who receives the capital.

Find out more about the beneficiary order and how to change it here.

Protect your life partner

Report your partner to your pension fund so that in the event of death the same benefits as for spouses can be granted.

At Profond, the following applies: A report is also possible if you and your partner do not live in the same household.

Read here what requirements need to be met and how to proceed with a report.

Payout of the 2nd pillar (pension fund) on leaving Switzerland

You are insured with Profond and are leaving the Switzerland/Liechtenstein economic area for good. Depending on the country of departure, different provisions apply to withdrawing the vested benefits as a lump sum.

Departure to an EU/EFTA country

- The non-compulsory part of the vested benefits may be taken as a lump sum. For payment, we need the details of your bank or postal account.

- The statutory part of the vested benefits (retirement assets in accordance with the BVG) remains in Switzerland. We ask you to inform us of a vested benefits institution of your choice for this part of the vested benefits.

- Special rules: If you are not subject to a mandatory social security obligation in your new state of residence, you can request the lump-sum payment of your statutory vested benefits from your vested benefits institution in arrears. The required form can be found on the website of the BVG Guarantee Fund office (sfbvg.ch)

Departure to a third country (non-EU/EFTA)

If you take up residence outside the EU/EFTA and are not obligatorily insured within the EU/EFTA, you can receive the entire vested benefits as a lump sum. For payment, we need the details of your bank or postal account.