On your pension certificate you can see how much money (retirement assets) you have already saved and what benefits you can expect in the event of retirement, disability or death.

Find out about the individual points:

- Click on the numbers to read more about each term

- Click on the play icon to get information via video

Alternatively, you can find a comprehensive e-learning on the pension certificate at Profond Insider.

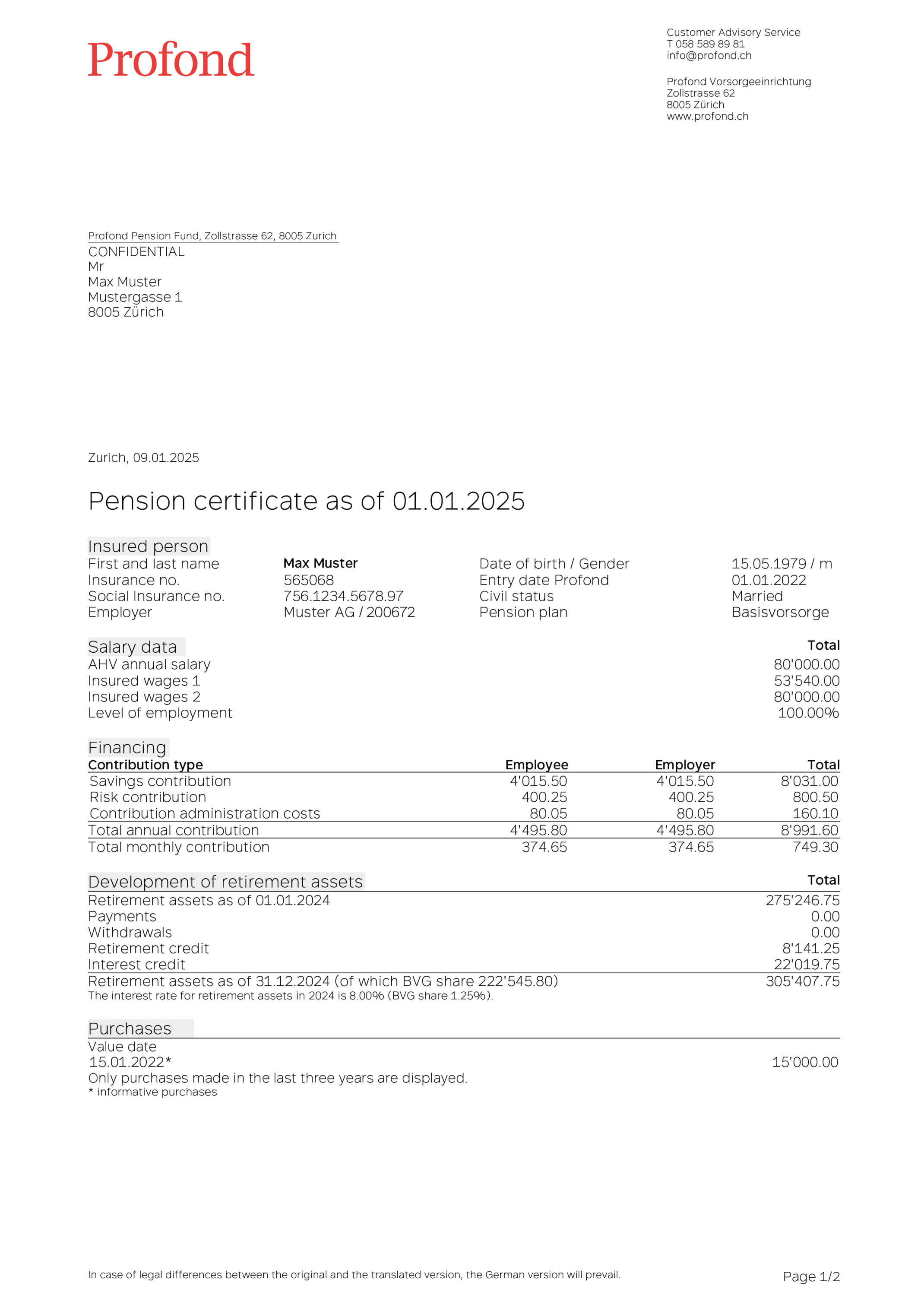

Here you will find your personal information (name, date of birth, marital status, etc.).

Important: Check this information and inform your employer if something is wrong.

This is the gross salary (salary before deductions) per year reported by the employer, including the 13th month's salary and - depending on the pension plan - bonuses.

This is the salary that is decisive for occupational pension provision/2nd pillar. The insured salary is often less than the AHV annual salary. Depending on the pension plan, a so-called coordination deduction is deducted. The statutory coordination deduction corresponds to 7/8 of the maximum annual AHV pension. This does not mean that the wage share, which is already covered by the AHV, is insured again.

You may have several insured wages – for example, one for retirement assets (saving) and one for risk protection (disability, death). You can find out what regulations apply to you in your pension plan. You will receive this from your employer.

Important: The insured salary forms the basis for the financing and therefore also for the benefits to which you are entitled.

Here you can see what amount will be saved for your personal occupational benefits. At least half of the amount will be paid by your employer and the other half will be deducted from your salary.

This amount is used to finance benefits in the event of death (point 7) and disability benefits (point 8). The amount is comparable to an insurance premium and is therefore not saved for old age.

This will cover the costs of managing your pension fund.

This section shows how your retirement assets have changed over the past year.

If you have generated a pension certificate in ProfondConnect as of the effective date or ordered it for a fee, all information relates to the current year.

Here are amounts that have been remitted and are credited to your retirement assets in addition to the retirement credit. These include, for example, transferred assets from previous pension funds, vested benefits, voluntary purchases, repayments of early withdrawals for home ownership or transfers due to divorce.

The amounts you have withdrawn from your retirement assets are listed under «Withdrawals». This may have been done, for example, for the financing of a home, a transfer due to a divorce or a partial withdrawal of capital in the event of partial retirement.

Here you will find the annual savings contributions that you and your employer have made.

You will receive interest on your existing retirement assets (as at: end of the previous year). This will be credited to you at the end of the year.

This is the current total amount of your saved pension fund money. This is based on your retirement assets (as at: the end of the previous year) plus deposits plus retirement credits plus interest minus withdrawals.

Here are your purchases from the last three years.

If you have not yet fully saved the retirement assets available under the regulations, you can voluntarily deposit money into the pension fund. These deposits are called purchases. You increase your retirement assets and can do so until your 70th birthday at the latest.

If early retirement is taken, your retirement pension will be reduced. This reduction can also be cancelled in whole or in part by purchasing. Profond will be happy to determine your purchase amount upon request.

More information: profond.ch/en/private-individuals/purchase

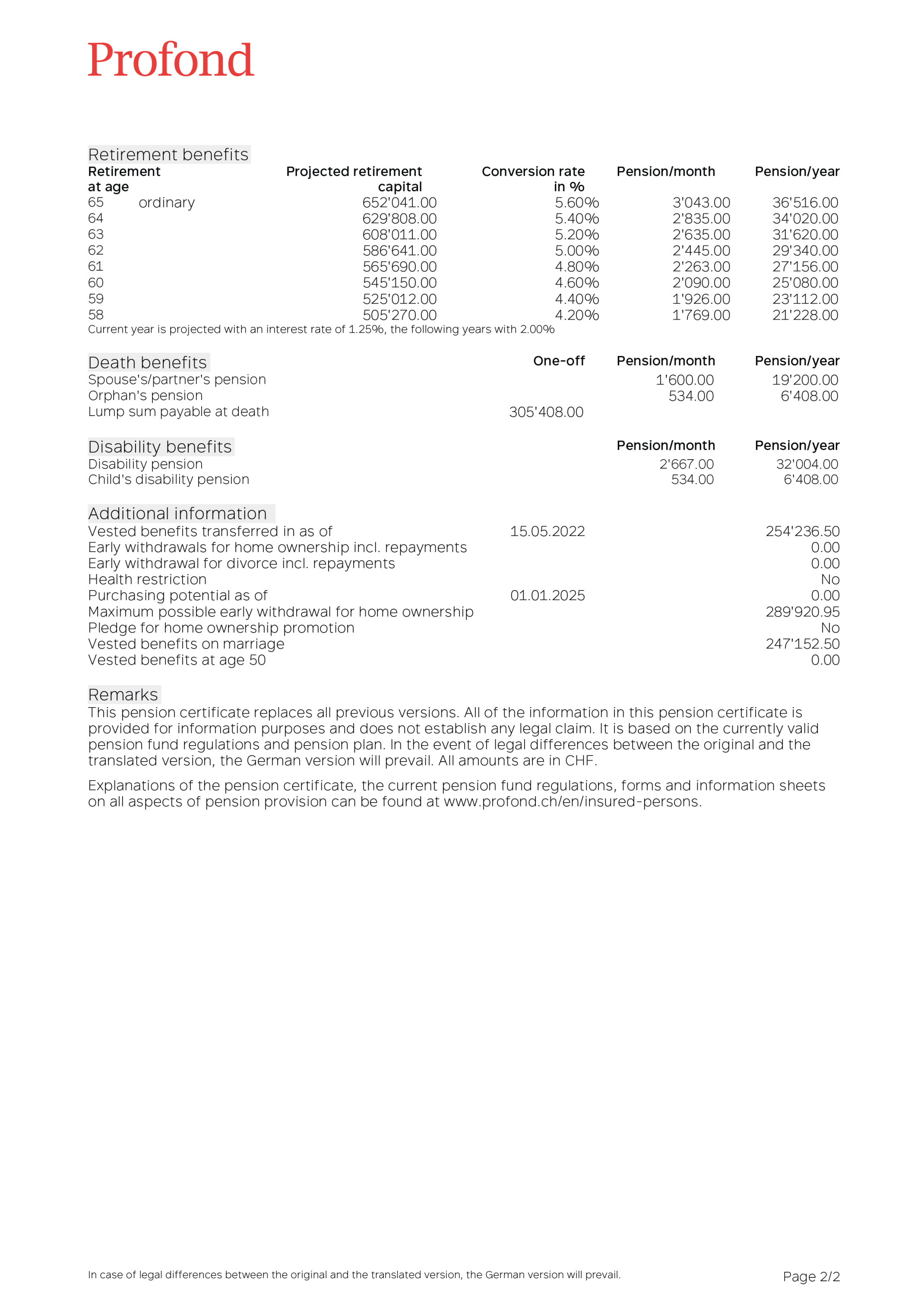

When you retire, you have various options to withdraw your saved retirement assets. Detailed information can be found at profond.ch/en/private-individuals/retirement.

On the pension certificate you will find your expected retirement assets ("projected retirement capital") and your expected pension based on this.

If your insured salary or your pension plan changes, the extrapolation of your retirement assets will be adjusted accordingly. The interest actually paid also affects the amount of your assets. The conversion rate at which the assets are converted into a pension may also change. As a result, your pension may be higher or lower. Profond generally announces the valid conversion rate years in advance.

If an insured person dies before retirement, their eligible dependents receive the benefits listed here.

Spouses and registered partners will receive a lifetime pension. Life partners may also be eligible. However, this partnership must always have been reported to Profond prior to the death by means of the corresponding form. In the event of death, it is then checked whether the conditions are met.

Important: If you live in a partnership but are not married or registered, please report your partner to us preferably today using the appropriate form.

Children receive an orphan's pension until their 18th birthday. If they are still in education, the pension may be paid until the person reaches the age of 25.

In the event of death before retirement, the entire accrued retirement assets will be paid out to the eligible persons. Those who are considered to be beneficiaries are set down in the regulations. The order can be adjusted using the form “Beneficiary order for a lump sum payable at death”. All information can be found at profond.ch/en/private-individuals/lump-sum-payable-death-my-options.

Depending on the pension plan, an additional lump sum payable at death may also be insured.

If you become incapacitated for a longer period of time, you can receive a disability pension from the Pension Fund after a waiting period (usually 720 days).

The prerequisite is that during this period wages or daily sickness benefits of at least 80% continued to be paid.

The pension amount is determined by the insured risk wage and the degree of disability:

- From 70% disability you receive the full pension.

- Between 40% and 69% you will receive a pro rata pension.

- There is no claim below 40%.

Depending on the cause (illness or accident), other insurance providers (e.g. disability insurance/accident insurance) also pay benefits. These benefits are coordinated with each other, as the total benefits are limited to a maximum of 90% of the previous salary.

If you receive a disability pension and have children under the age of 18, you are also entitled to a child's disability pension. If the children are still in education, the pension may, under certain circumstances, be paid until they turn 25.

If you have transferred money to Profond from a previous pension fund or vested benefits account, you can see the amount here.

If you have received money from the pension fund to buy or renovate residential property, you can see the corresponding amount here.

If funds from your pension fund are transferred to your ex-wife or ex-husband in the event of a divorce, you can see the amount here. The amounts you have received are also listed here.

Profond may impose a restriction for health reasons for the risks of death and disability. This may not exceed five years.

The purchasing potential shows how much you can add to your pension fund.

The amount you can actually deposit depends on the time of purchase and other factors. Before each purchase, we ask you to submit the application for a purchase of full regulatory benefits. To do this, click on "Simulations with application" in the menu of the insurance portal ProfondConnect and then on "Purchase".

You can find all information and benefits on purchasing here: profond.ch/en/private-individuals/purchase

Here you can see how much money you could currently withdraw from the pension fund to buy or renovate owner-occupied residential property. Further information on home ownership promotion can be found at profond.ch/en/private-individuals/ownership-promotion.

Alternatively, you can pledge the assets listed here to purchase or renovate owner-occupied residential property.

When you get married or enter into a registered partnership, it will be noted how many retirement assets you have saved until then. Vested benefits and withdrawals for home ownership acquired during the marriage are divided in half during the divorce.

The law requires that your assets be held at the age of 50. As a rule, this amount corresponds to the maximum amount for subsequent withdrawals within the framework of home ownership promotion.

All information on this model pension certificate and the declarations on the pension certificate are for information purposes and do not constitute a legal claim. It is based on the currently valid pension fund regulations and pension plan.

The projected interest rate

The projected interest rate is used to estimate retirement assets and retirement pensions at the time of retirement age. This is a hypothetical interest rate. In accordance with the Pension Fund Regulations, it corresponds to the technical interest rate of Profond.

To give you an approximate idea of the amount of your retirement assets at retirement, the estimated retirement assets and the estimated annual retirement pension are listed on the pension certificate. For this calculation, the retirement assets are remunerated at the BVG minimum interest rate in the current year and at the projected interest rate for subsequent years until retirement. The projected retirement benefits and associated retirement pensions are therefore projections which are not guaranteed and from which no legal claim can be derived.

In general terms: The savings credits and the effective annual interest rate, which the Foundation Board determines each year, are decisive for the amount of the future actually existing retirement assets. The amount of the conversion rate also plays a role for the retirement pension.