With option-plans, you give your employees more freedom in their pension provision – while, at the same time, positioning yourself as a modern, attractive employer.

The retirement assets in the occupational retirement benefits are built up from the contributions of employees and employers. In addition, there is the interest that is earned over the entire investment period.

The amount of monthly savings contributions therefore plays a decisive role in the later retirement pension. By offering option-plans, you give employees the opportunity to actively influence their future pension.

What are option-plans?

With an option-plan, your employees can choose from up to three different savings solutions and choose how much they pay into their pension fund. The law stipulates that the total monthly contributions of the employer must be at least equal to the total contributions of all employees. In addition, a percentage dependent on age is defined, which is deducted directly from the salary. These provisions also apply to option-plans.

What needs to be considered?

- Option-plans must be set out in the pension plan.

- Up to three option-plans can be offered per group of people.

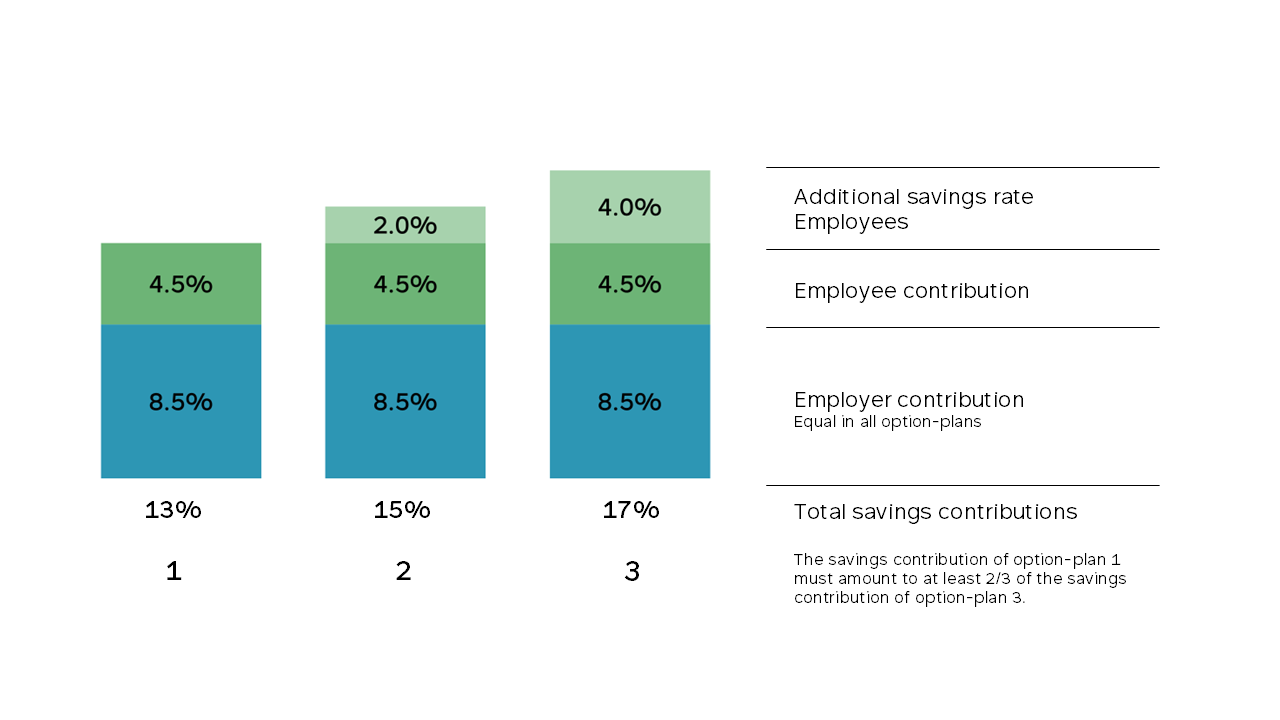

- The employer's contribution is the same in each option-plan, only the employee's contribution differs per plan. This ensures that no employees are favoured.

- The savings contributions in the option-plan with the lowest contribution rates must be at least 2/3 of the savings contributions of the plan with the highest contribution rates.

Example of three option-plans with different employee savings contributions:

Benefits for your employees:

- Selection of personal savings contribution according to personal options and needs

- Actively save more for retirement (with fully tax deductible contributions)

- Create additional purchasing potential

- Flexible design thanks to annual changeover possibilities

Get advice

Would you like to give your employees more room for manoeuvre in terms of occupational benefits? Get advice and give your employees the chance to save more for retirement.